November 25, 2024

Navigating financial growth that aligns with Islamic principles can be a rewarding challenge in a world brimming with investment opportunities. Whether crafting e-commerce business plans or seeking other avenues, understanding halal investment options is crucial for ethical financial growth. This blog post explores diverse halal ways to invest your money, ensuring your ventures are both profitable and compliant with Islamic values.

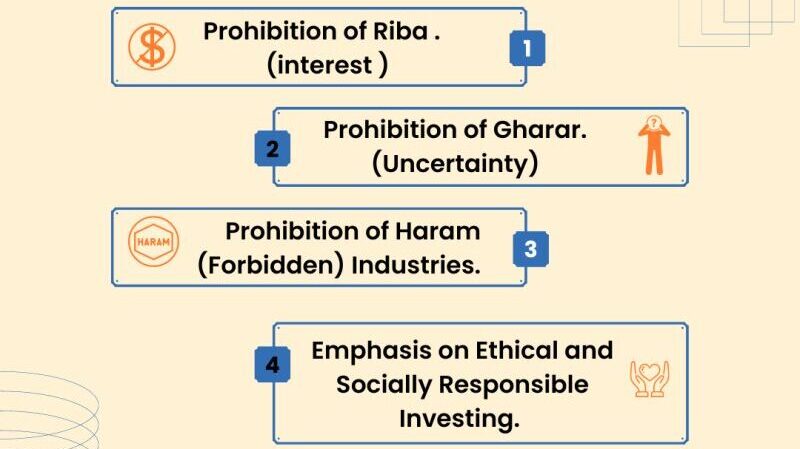

Halal investment is deeply rooted in Islamic law, emphasising ethical conduct, social responsibility, and interest-free financial growth. The cornerstone of halal investing is the avoidance of riba (interest), ensuring that earnings come from permissible activities. This involves steering clear of haram (prohibited) industries such as alcohol, gambling, and pork and businesses that engage in unethical practices. Additionally, investments should ensure justice and fairness, avoiding excessive risk or speculation, known as gharar. Transparency and honesty in financial dealings are paramount, and investors should seek opportunities that promote social welfare and economic justice. Adhering to these principles can create a balanced and ethical investment strategy.

Halal savings accounts and Sukuk offer accessible starting points for those venturing into halal investments. Islamic banks provide savings accounts that adhere to profit-sharing models instead of earning interest, ensuring compliance with Islamic principles. These accounts allow you to grow your savings ethically, with profits distributed based on the bank’s performance and your account balance.

Sukuk, commonly known as Islamic bonds, represent another viable investment. Unlike conventional bonds, Sukuk structures involve owning a share in a tangible asset, project, or investment enterprise. The returns on Sukuk are generated from the profits produced by these underlying assets rather than interest payments, aligning with the prohibition of riba (interest).

Both halal savings accounts and Sukuk are designed to align with Islamic finance principles, offering a blend of security and ethical growth. They provide opportunities for steady returns without engaging in prohibited activities, making them suitable for investors seeking both financial stability and religious adherence. These instruments cater to varying risk appetites and investment horizons, allowing you to diversify your portfolio while upholding your values. By incorporating these options, you can start building a foundation for halal financial growth, paving the way for more advanced and diversified investment strategies in the future.

Halal mutual funds offer a practical and ethical approach to investing. They pool resources from multiple investors to create a diversified portfolio of Shariah-compliant stocks and securities. These funds undergo rigorous screening processes to ensure they exclude businesses involved in activities prohibited by Islamic law, such as alcohol production, gambling, and conventional financial services. By adhering to these guidelines, halal mutual funds ensure that your investments align with your values while providing an opportunity for financial growth.

Professional fund managers oversee these portfolios, bringing expertise and experience to the table. This can be particularly beneficial for investors who may not have the time or knowledge to manage their own investments. This professional management helps select stocks and securities that not only comply with Islamic principles but also offer strong growth potential and risk mitigation.

Additionally, investing in halal mutual funds allows you to achieve diversification, spreading your investment across various sectors and companies, which can reduce the risk associated with individual stocks. This diversified approach ensures that your investment is more resilient to market fluctuations and economic downturns.

Moreover, halal mutual funds often offer options tailored to different risk tolerances and investment goals, from conservative income-focused funds to more aggressive growth-oriented ones. This flexibility allows you to choose a fund that best matches your financial objectives and risk appetite while maintaining adherence to Islamic values.

Real estate investment provides a tangible, asset-backed method to grow your wealth while adhering to Islamic finance principles. This type of investment is favoured because it involves real, physical assets rather than speculative ventures. Whether through residential, commercial, or rental properties, real estate can generate steady income and appreciation over time, aligning well with the prohibition of riba (interest) and gharar (excessive uncertainty).

By investing in property, you have the opportunity to engage in ventures that are ethically sound and socially responsible. For instance, investing in residential properties not only provides you with a source of rental income but also contributes to the community by offering quality housing. Similarly, commercial properties can yield substantial returns, especially in thriving business areas, and can serve as ethical investment vehicles when leased to Sharia-compliant businesses.

Additionally, real estate investments often come with the potential for value appreciation. Over time, the value of property generally increases, providing a hedge against inflation. This makes real estate a valuable component of a diversified investment portfolio, particularly for those seeking long-term growth.

Furthermore, the ability to leverage financing in a manner compliant with Islamic principles, such as through profit-sharing arrangements, adds to the attractiveness of real estate as a halal investment. This allows for greater financial flexibility while maintaining adherence to ethical guidelines.

Investing in Shariah-compliant companies allows you to participate in the equity market while ensuring your investments align with Islamic values. These companies operate in permissible industries and follow ethical business practices. Research and financial analysis are essential in identifying suitable stocks that offer growth potential without compromising your beliefs. This approach can be an integral part of a diverse halal investment portfolio.

Shariah-compliant companies are vetted to ensure they do not engage in prohibited activities like alcohol production, gambling, or interest-based financing. This rigorous screening process assures that your investments adhere to Islamic principles. Additionally, these companies often have lower debt levels, as excessive leverage is avoided, making them more financially stable.

Equity investments in Sharia-compliant companies can offer robust financial returns. Many of these companies are leaders in sectors such as healthcare, technology, and manufacturing, which are often considered resilient and growth-oriented. By selecting stocks within these industries, you can achieve a balanced investment strategy that promotes both ethical values and financial growth.

Moreover, investing in Shariah-compliant equities allows you to support businesses that prioritize social responsibility and ethical governance. These companies often implement sustainable practices and fair labour policies, contributing positively to society. Engaging in equity investments with such companies ensures your financial growth is intertwined with ethical impact, making it a valuable component of a halal investment strategy.

Investors have long regarded gold and other precious metals as secure and reliable investments. They are physical assets that inherently retain value, making them effective safeguards against inflation and economic instability. Unlike conventional investment options that may involve interest or speculative risks, investing in gold and precious metals complies with Islamic principles. These assets provide a stable foundation for your investment portfolio, offering a tangible form of wealth that remains resilient during market fluctuations.

The appeal of precious metals extends beyond their financial stability. Gold, silver, and other metals have intrinsic value and historical significance, making them universally accepted forms of currency and trade. This global acceptance ensures liquidity, enabling investors to convert their holdings into cash with ease. Additionally, the demand for precious metals in various industries, such as technology and jewellery, contributes to their sustained value and growth potential.

Through various means, an individual can actively invest in precious metals by purchasing physical bullion or coins or participating in commodity trading. Each method has its own set of advantages, allowing investors to choose the approach that best aligns with their risk tolerance and investment goals. By including gold and precious metals in your investment strategy, you enhance the diversification and stability of your halal portfolio.

Starting a halal business allows you to directly engage in ventures that adhere to Islamic values and principles. Whether you’re interested in creating e-commerce business plans or exploring other entrepreneurial avenues, a halal business can serve as a rewarding investment. By owning and operating your enterprise, you gain control over every aspect of the business, ensuring that all operations, from sourcing to sales, comply with Islamic law. This control allows for ethical labour practices, fair pricing, and transparency, fostering a positive and responsible business environment.

Additionally, a halal business can tap into a growing market of consumers who prioritize ethical and Sharia-compliant products and services, providing a competitive advantage. Leveraging technology and innovative business models can further enhance your venture’s success. For example, e-commerce platforms enable you to reach a global audience while maintaining low overhead costs. This business approach generates income and promotes ethical consumerism and social responsibility, aligning with the core tenets of Islamic finance. A halal business can be a powerful vehicle for both financial success and positive social change by focusing on sustainable growth and community impact.

Islamic crowdfunding platforms present a unique way to invest in and support projects that align with Islamic values. These platforms facilitate connections between investors and entrepreneurs seeking Shariah-compliant funding, providing a transparent and ethical investment opportunity. By leveraging the collective financial power of the community, these platforms democratize access to capital, enabling smaller ventures to thrive without resorting to interest-based financing. Investors can participate in a diverse array of projects, from tech startups to social enterprises, all while adhering to Islamic finance principles. This collaborative approach fosters innovation and growth in sectors that prioritize ethical conduct and social responsibility. Additionally, the profit-and-loss sharing model ensures that both parties share in the success and risk of the venture, aligning incentives and promoting fairness. This makes Islamic crowdfunding an attractive option for those seeking to diversify their investment portfolios while staying true to their values.

Peer-to-peer (P2P) lending within Islamic finance provides an innovative, interest-free approach to borrowing and lending. Unlike conventional loans that involve riba (interest), P2P lending platforms based on Islamic principles employ profit-and-loss sharing models that are Shariah-compliant. This method ensures that both the lender and the borrower share the financial outcomes, fostering fairness and ethical conduct.

These platforms enable direct financial interactions between individuals, bypassing traditional banks and financial institutions. This directness not only reduces costs but also promotes transparency and trust among participants. For investors, P2P lending offers a unique opportunity to diversify their portfolios while adhering to Islamic values. It allows you to invest in various projects, from small business ventures to personal loans, providing returns derived from legitimate profit-generating activities.

Moreover, P2P lending platforms typically include rigorous vetting processes to ensure that the borrowers and their projects align with Islamic ethics. This means that investments are directed toward ventures that are socially responsible and ethically sound, avoiding industries like gambling, alcohol, and speculative enterprises.

Engaging in P2P lending also allows you to support the financial growth of individuals and businesses within your community. By participating in these ethical lending practices, you contribute to a more equitable financial system that benefits both lenders and borrowers. This form of investment not only aligns with your faith but also offers a practical, socially responsible way to achieve financial growth.

Halal investing provides a myriad of avenues to grow your wealth ethically. From leveraging the stability of real estate and gold to exploring innovative options like Islamic crowdfunding and peer-to-peer lending, there are numerous strategies to diversify your portfolio. Engaging in these investment methods not only ensures compliance with Islamic principles but also supports socially responsible and ethical ventures. Whether you choose to start a halal business, invest in Shariah-compliant equities, or pool resources through halal mutual funds, each path offers unique benefits and growth potential. By carefully selecting investments that align with your values, you can achieve financial success while upholding your faith.

© 2025 Rizkonomist.com, All right reserved.